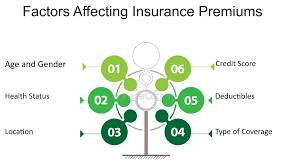

Key Elements of Understanding Insurance Premium

An insurance premium is the amount an insurance company charges a company or individual for maintaining an active insurance plan. This premium in life insurance guarantees the insurance company offers financial protection to the beneficiaries of the policyholder upon passing. Onetime payment for the whole policy period, annually, quarterly, or monthly premiums payments can be made. Depending on a number of risk elements, insurance charges differ among individuals. Although premium calculation depends on several factors, let’s go over a few of the most significant ones in more detail. QuoteRadar is quite beneficial as it lets you avoid the hassle of comparing different policies and makes this comparison simple for you by its comparison tool.

Age:

Determining an insurance premium depends on many elements, but one of the most important is age. A life insurance policy bought at a younger age usually has a lower premium. This is so because younger people statistically have lower chances of having major medical conditions or dying throughout the policy term.

By means of mortality tables, insurance companies estimate the typical life expectancy of individuals in varying age groups. This data enables them to evaluate the policyholder’s life expectancy and billing requirements. Increasing age raises the perceived risk, therefore influencing the sum of the premium. A 25 year old purchasing a life insurance policy, for instance, would probably pay much less than another purchasing the same coverage at 45. A noticeable difference in the rate can result from just a couple years of age difference. Visit https://www.quoteradar.co.uk/ to know more about all kinds of insurance so that you can better protect yourself, your family and your possessions.

Medical History and Current Health:

Life insurance rates are much based on health status. During the application process, insurance firms usually will want a health questionnaire or medical test. It encompasses blood tests, body measurements, and inquiries on any prior or present medical issues.

Generally, someone without pre-existing conditions gets a less premium than one with a history of health problems including diabetes, high blood pressure, heart disease, or cancer. Even with ongoing therapy for the disease, the premium could be affected based on the probability of recurrence. Furthermore taken into account by insurers is family medical background. Even if the policyholder is now well, if close family has experienced chronic or hereditary disorders, they may be classified as high risk.

Smoking and Lifestyles:

Lifestyle choices particularly smoking affect life insurance rates straightaway. Smoking is well linked to major diseases like cancer, lung disease, and heart problems; therefore, smokers are seen as high risk. Their rates, therefore, are usually much more than non-smokers.

Regular smokers, occasional users, and smokers who have recently given up cigarette could be distinguished by insurance companies. Often the label “non-smoker” is granted only after a person has quit smoking for at least 12 years. Other lifestyle choices such as lack of exercise, poor diet, and frequent alcohol use can also indirectly affect the premium 0articularly if they have resulted in health issues.

Nature of Occupation:

The insurance cost may also be influenced from the kind of employment one has. High risk professionals—such as construction workers, police officers, firefighters, pilots, and military members—typically have higher premiums. These positions have a higher likelihood of injury or lethal accidents, elevating the risk for insurance providers. Conversely, people with desk careers or jobs having little physical danger typically get reduced premiums. Sometimes the working environment — say exposure to chemicals, severe weather, or unsteady location — can also count as a factor.

Area of Residence:

Life insurance rates might also be swayed by a person’s location. Factors like whether the zone has high crime levels, poor air quality, little access to medical care, or a past of natural calamities is also considered by insurance providers. Residing in an area with any of these hazards may cause one’s premium to rise.

Even within one country, premium rates might vary by postal code particularly in urban versus rural areas. Location data is utilized by a few insurance firms to evaluate the typical environmental features, life expectancy, and health risks in a specific region.