Inside the Ashcroft Capital Lawsuit: What Investors Need to Know

The financial landscape is always shifting, but few events shake the foundation of investor trust like a high-profile lawsuit. The Ashcroft Capital lawsuit has captured attention across the real estate investment community, leaving many wondering about its implications. What does this case mean for investors? Are there lessons to be learned from it? In this blog post, we’ll take you behind the scenes of the Ashcroft Capital case and explore everything you need to know as an investor navigating these turbulent waters. Buckle up—insights await!

Inside the Ashcroft Capital Case: What Investors Need to Know

The Ashcroft Capital lawsuit has emerged as a pivotal moment in the real estate investment sector. Investors are keenly observing developments, eager to understand how this case could reshape industry standards and investor protections.

With multiple claims surfacing against the firm, concerns about transparency and fiduciary responsibility have intensified. As legal proceedings unfold, stakeholders must remain vigilant and informed about potential ramifications for their investments in real estate syndications. The outcome may set precedents that affect future ventures significantly.

Origins of the Ashcroft Capital Lawsuit

The origins of the Ashcroft Capital lawsuit trace back to allegations involving mismanagement and misleading practices. Investors claimed that they were not given full disclosure about fees, financial performance, and risks associated with their investments.

As details emerged, concerns grew over the transparency of Ashcroft Capital’s operations. The situation escalated quickly as investors sought legal action to protect their interests. This sparked a wider conversation about accountability in real estate syndication practices within the industry.

Core Claims in the Ashcroft Capital Lawsuit

The Ashcroft Capital lawsuit revolves around serious allegations of misrepresentation and breach of fiduciary duty. Investors claim that the company failed to disclose critical financial risks associated with its projects, leading to significant losses.

Additionally, there are accusations regarding the improper use of investor funds. Critics argue that these funds were diverted away from intended purposes, raising ethical concerns within the investment community. The claims highlight potential vulnerabilities in real estate syndication practices, prompting many investors to reassess their strategies moving forward.

Potential Fallout for Investors and the Industry

The Ashcroft Capital lawsuit has raised eyebrows across the real estate investment landscape. Investors are now questioning the stability and transparency of syndication deals. The ripple effect could deter potential investors from participating, leading to a slowdown in capital flow.

Industry professionals may also face increased scrutiny and regulatory pressures. This heightened vigilance can create challenges for legitimate operators striving to build trust. As uncertainties loom, understanding these dynamics becomes crucial for all stakeholders involved.

How to Navigate Syndication Risk in Light of the Ashcroft Capital Lawsuit

Navigating syndication risk requires vigilance and due diligence. Investors should thoroughly research the syndicator’s track record, focusing on past performance and legal issues. Understanding their operational transparency can provide insights into potential red flags.

Engaging with current investors can reveal firsthand experiences, helping gauge trustworthiness. Additionally, diversifying investments across multiple projects lowers exposure to any single lawsuit’s impact. Establishing clear communication channels with syndicators is essential for staying informed about developments that could affect your investment strategy.

Ashcroft Capital’s Defense and Next Steps

Ashcroft Capital is mounting a robust defense against the lawsuit claims, emphasizing their commitment to transparency and ethical practices. The firm argues that the allegations misrepresent their operations and investment strategies, asserting that they have adhered strictly to regulatory standards.

As legal proceedings unfold, Ashcroft plans to engage with stakeholders proactively. They aim to reassure investors by providing updates on both the case’s progress and ongoing business activities. This approach seeks to maintain investor confidence amid uncertainty surrounding the litigation.

Broader Lessons for Real Estate Syndication Participants

The Ashcroft Capital lawsuit serves as a stark reminder for real estate syndication participants about the importance of transparency. Investors should demand clarity on fees, risks, and investment strategies from sponsors. Open communication can mitigate misunderstandings that lead to legal disputes.

Additionally, due diligence is crucial. Participants must thoroughly investigate potential partners and understand their track records. By prioritizing these factors, investors can protect themselves against similar pitfalls in future ventures within the real estate landscape.

Overview of the Lawsuit

The Ashcroft Capital lawsuit centers around allegations of mismanagement and breach of fiduciary duty. Investors claim that the company failed to uphold its responsibilities, leading to significant financial losses.

This case highlights a growing concern within the real estate syndication sector. With increasing scrutiny on investment practices, stakeholders are closely monitoring how this legal battle unfolds and what implications it may carry for similar ventures in the future.

What Led to the Lawsuit?

The Ashcroft Capital lawsuit emerged from allegations surrounding mismanagement and misleading financial practices. Investors claimed that they were not fully informed about the risks associated with their investments, leading to significant financial losses.

As concerns grew, former partners and employees began to speak out against the firm’s operations. This created a ripple effect, raising questions about ethical standards in real estate syndication and prompting investors to seek legal recourse for their grievances.

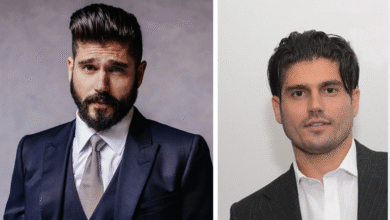

Key Players Involved in the Lawsuit

The Ashcroft Capital lawsuit features several key players, including the company’s founders and investors. The allegations primarily focus on mismanagement and misleading financial practices tied to various syndication deals.

Investors who feel wronged have come forward as plaintiffs in this case. Their testimonies highlight concerns over transparency and trust within the real estate sector, emphasizing the stakes involved for both sides. As these individuals navigate their claims, attention is drawn to how these dynamics will unfold in court.

Impact on Investors and Stakeholders

The Ashcroft Capital lawsuit has sent ripples through the investor community. Many feel uncertain about their financial commitments and the overall stability of their investments. Trust, once a cornerstone of real estate syndication, now faces scrutiny.

Stakeholders are reassessing risk management strategies and due diligence practices. There’s an increasing demand for transparency in investment deals. This case could change how investors engage with syndicators moving forward, prompting a shift toward more cautious approaches in future ventures.

Updates on the Lawsuit and Settlements

Recent developments in the Ashcroft Capital lawsuit have raised eyebrows across the real estate investment community. As negotiations progress, stakeholders are eager for clarity on potential settlements and their implications.

Court hearings have revealed key evidence that could influence the outcome. Investors are closely monitoring updates, hoping for resolutions that protect their interests while navigating this complex legal landscape. The next few months will be crucial as both parties work toward an agreement or prepare for trial.

Lessons Learned from the Ashcroft Capital Lawsuit

The Ashcroft Capital lawsuit highlights the importance of due diligence. Investors must thoroughly vet syndication deals and understand all associated risks. Relying solely on promises can lead to significant financial loss.

Transparency is crucial in real estate investments. The case shows that clear communication between sponsors and investors can prevent misunderstandings. Being proactive about inquiries can empower investors, allowing them to make informed choices while navigating complex syndications.

What the Ashcroft Capital Lawsuit Means for Future Real Estate Ventures

The Ashcroft Capital lawsuit serves as a cautionary tale for future real estate ventures. Investors are now more aware of the complexities and risks associated with syndication deals. Transparency in operations is no longer optional; it’s crucial.

As the industry evolves, stakeholders must prioritize due diligence and regulatory compliance. This case will likely drive changes in how investment groups communicate, shaping a new standard that emphasizes accountability to protect investor interests moving forward.

Background and details of the lawsuit

The Ashcroft Capital lawsuit emerged as a significant case in the real estate investment sector. It centers around allegations of mismanagement and failure to disclose critical information to investors, raising serious concerns about transparency within syndication practices.

Details reveal claims that investor funds were not utilized as promised, leading to substantial financial losses for stakeholders. The situation sparked intense scrutiny from regulators and highlighted the importance of due diligence in real estate investments. Many are now watching closely as developments unfold.

Impact on real estate investors and market

The Ashcroft Capital lawsuit has sent ripples through the real estate investment community. Investors are feeling a mix of uncertainty and anxiety, prompting many to reconsider their syndication strategies. As trust wavers, some may hesitate before committing capital to new ventures.

Market dynamics are also shifting as participants take a more cautious approach. This shift could lead to tighter funding conditions for real estate projects, impacting development timelines and potential returns on investments across the sector.

Lessons learned from the lawsuit

The Ashcroft Capital lawsuit has shed light on the importance of due diligence. Investors must thoroughly vet syndication deals and their sponsors to avoid unforeseen risks. Understanding the financial health and track record of a company is crucial.

Transparency in communication is equally vital. Clear disclosures regarding fees, potential conflicts, and investment strategies can safeguard investors from surprises down the line. The case serves as a reminder that vigilance is key when entering real estate ventures.

Steps to protect yourself as a real estate investor

Real estate investing can be rewarding, but it also carries risks. To safeguard your investments, conduct thorough due diligence. Understand the syndication process and scrutinize all investment documents.

Diversification is key; don’t put all your funds into one project or sponsor. Stay informed about market trends and legal developments like the Ashcroft Capital lawsuit. Establish relationships with reputable sponsors who have a track record of success.

Consider working with financial advisors who specialize in real estate to better navigate complex situations. Awareness of potential pitfalls will empower you as an investor, making you more resilient against unforeseen challenges in the industry.